All Categories

Featured

Table of Contents

- – Employee Benefits Management Solutions Villa Pa...

- – Harmony SoCal Insurance Services

- – Payroll Services For Small Business Villa Park...

- – Payroll Services Villa Park, CA

- – Payroll Services Small Business Villa Park, CA

- – Best Payroll Services For Small Businesses Vi...

- – Local Payroll Services Villa Park, CA

- – Top Employee Benefits Brokers Villa Park, CA

- – Payroll Service For Small Businesses Villa P...

- – Church Payroll Services Villa Park, CA

- – Payroll Services For Small Business Villa Pa...

- – Local Payroll Services Villa Park, CA

- – Payroll And Services Villa Park, CA

- – Key Man Insurance Vs Life Insurance Villa Pa...

- – Harmony SoCal Insurance Services

Employee Benefits Management Solutions Villa Park, CA

Harmony SoCal Insurance Services

2135 N Pami Circle Orange, CA 92867(714) 922-0043

Harmony SoCal Insurance Services

Every organization is special and your pay-roll system have to reflect that. Take into consideration the list below aspects when specifying your organization's payroll needs: Do you require pay-roll processing for 5 or 500 customers?

Your team might consist of hourly, employed and contract employees. Guarantee your service provider can handle this degree of complexity. You might have staff in various states and even abroad. If so, guarantee your provider can handle out-of-state and global payments. If you provide medical insurance, retired life contributions or other advantages, ensure your pay-roll service can accommodate your demands.

Ensure your supplier uses these integrations. Some payroll software application companies supply staff member self-service choices that allow personnel to access payroll details, tax return and leave balances. This attribute can reduce the workload for your internal human resources division and local business owner. Determine a practical payroll service spending plan that accommodates your staff requirements and the attributes you require.

Payroll Services For Small Business Villa Park, CA

Select a business that stays current on brand-new regulations that might enter into result. If the answer is of course, the software likely brings industry-specific experience to the table. While this isn't a must-have credentials for a payroll solution, it can be an affordable advantage. Smooth integration with other fringe benefit will certainly make the procedure smoother and less time-consuming.

Protected payroll software program shields sensitive details like worker addresses, birth days, Social Protection numbers and bank information from unapproved access. The negative aspects of pay-roll software program include these elements: Understanding to make use of payroll software program and training others can be taxing, particularly if the software application has a complex interface or extensive functions.

If your company has intricate payroll schedules or rigid conformity demands, some software might not totally satisfy your requirements. Mark Fairlie added to this post. Resource interviews were conducted for a previous version of this write-up.

One research study showed that 61% of companies outsourced their pay-roll to an external business, revealing the appeal of this method. A lot of organizations begin off administering their very own payroll. As they expand, the factors to begin contracting out end up being much more compelling. Right here are five reasons you ought to outsource your pay-roll services: Taking care of pay-roll in-house calls for a considerable time financial investment and focus to detail.

Payroll Services Villa Park, CA

They recognize the intricacies included, consisting of regulation, tax prices, regulatory modifications, and the most up to date pay-roll modern technology. Their knowledge can be specifically beneficial for organizations that run in multiple territories, nations, or regions with differing tax regulations and reporting requirements. Pay-roll errors can be expensive in regards to both financial resources and employee contentment.

It will frequently seem like they are an expansion of your in-house group as opposed to collaborating with a 3rd party. They are most likely to supply tailored and flexible solutions tailored to your needs. Working with an independent service provider may be much more affordable for small services with simple pay-roll needs.

An independent service provider may not have the capacity to range services promptly as your organization grows. They may not have accessibility to the same degree of innovation and software application as larger companies, which might influence performance and safety. In no specific order, here are 11 top pay-roll contracting out business understood for their experience and dependability, including leading outsourcing firms and staffing and recruiting companies that source bookkeeping ability.

Payroll Services Small Business Villa Park, CA

The provider must stay upgraded on relevant laws and make certain that your payroll processes are legally sound. Evaluate the innovation and devices the provider utilizes. Are they user-friendly, safe, and suitable with your existing systems? Scalability is one more crucial facet, specifically if your organization plans to broaden in the near future.

Every service is one-of-a-kind and your payroll system have to mirror that. Take into consideration the following variables when specifying your service's payroll requires: Do you require pay-roll handling for 5 or 500 users?

Guarantee your supplier can manage this level of intricacy. If so, guarantee your company can handle out-of-state and worldwide settlements., retired life payments or various other advantages, guarantee your pay-roll service can accommodate your demands.

Best Payroll Services For Small Businesses Villa Park, CA

Guarantee your carrier uses these combinations. Identify an affordable pay-roll service spending plan that fits your staff requirements and the functions you need.

Choose a firm that remains current on new legislations that may go right into result. While this isn't an essential credentials for a payroll solution, it can be a competitive advantage.

Safe payroll software application secures sensitive information like worker addresses, birth days, Social Safety and security numbers and financial institution information from unauthorized accessibility. The downsides of pay-roll software application include these variables: Knowing to utilize payroll software program and training others can be taxing, especially if the software program has an intricate user interface or extensive functions.

Local Payroll Services Villa Park, CA

If your company has complex payroll schedules or rigid conformity demands, some software application may not completely meet your demands. Mark Fairlie added to this write-up. Source meetings were carried out for a previous version of this write-up.

They wish to really feel taken treatment of, comprehended, and like a companion in the process, not simply an additional customer on a spreadsheet. They want a pay-roll firm that would take a tailored strategy that permits them to concentrate on the large picture while we concentrate on the information that will certainly obtain them there.

"Are You Looking For Worldwide Payroll Expert?" Allow's consider the leading 15 international pay-roll provider. A globally payroll provider addresses the organization's human source needs and advantages. Before picking a payroll service, think about the elements that will certainly help you select the finest payroll service for your organization.

Evaluation the abilities you intend to obtain or boost and just how you will certainly determine success. Think about unifying your pay-roll processes for all your worldwide staff into one system or enhancing your compliance monitoring capabilities to stay clear of legal risks. Comparing payroll provider endlessly without considering the outcomes you intend to accomplish will throw away a great deal of important time.

Top Employee Benefits Brokers Villa Park, CA

We are a Worldwide Employer of Record (EOR) and HR solution. With business and regional experts in 214 nations and regions, we can employ, onboard, and pay your employees throughout the world. We assist you to include the biggest people to your group, no matter of where they are. Over the last 22 years, we have actually assisted creative startups and Lot of money 500 companies in their global advancement.

Their distributed team helps businesses throughout the globe. They offer entire personnel work remotely from various areas throughout the world. Company of Document (EOR) Specialist Administration Global Payroll Remote Relocation Growth Consulting Solutions Rippling gets rid of the rubbing of running a business. It is a labor-management software program that integrates HR, IT, and money.

For 70 years, they established the standard for identifying the future of organization remedies. ADP is just one of the leading worldwide payroll solution providers and vendors of cloud-based human capital monitoring (HCM) systems that integrate payroll, HR, skill, time, tax, and advantages, as well as a pioneer in company outsourcing and analytics.

Payroll Service For Small Businesses Villa Park, CA

Remofirst was created in 2021, with a focus on remote procedures from the begin. The purpose is to make it easier for services to set up remote groups and gain the badge of international pay-roll solution suppliers.

All QuickBooks Online options consist of an one-time guided configuration with a professional and customer aid. They supply the very best payroll solution remedies to clients. Accounting Advanced Bookkeeping Digital accounting Pay-roll Pay contractors Time tracking Settlements and financial Venture Cloud Pay groups constantly try to create an atmosphere in which everyone, despite work or area, is appreciated, heard, influenced, and urged to be their real selves at the workplace.

Church Payroll Services Villa Park, CA

With the adhering to core worths: A versatile and encouraging ambience. A varied culture. Worker Well-being Providing back Global Payroll Global Repayments Global Pay On-Demand The world of global pay-roll solutions is quickly changing, driven by the expanding demand for accurate and compliant payroll handling in a worldwide setup. The top 15 around the world pay-roll service carriers supply a selection of services to fulfill the specific needs of companies operating worldwide.

ADP mobile services provide employees accessibility to their pay-roll info and advantages, no issue where they are. Employees can finish a selection of tasks, such as view their pay stubs, manage their time and attendance, and go into time-off demands.

That's why many companies turn to payroll solution carriers for automated options and conformity experience. A payroll service may still be of assistance.

Payroll Services For Small Business Villa Park, CA

Processing payroll in numerous states needs tracking, understanding and conforming with the tax obligation regulations and regulations in all states where you have employees. If you're doing pay-roll manually currently and strategy to change to a pay-roll service carrier, you ought to anticipate to reduce the time you dedicate to the process.

ADP offers pay-roll services for organizations of all sizes small, midsized and huge. We additionally accommodate numerous industries, consisting of building, manufacturing, retail, healthcare and more. ADP's pay-roll services are automated, making it very easy for you to run payroll. Here are a few of the key actions to the process that we'll handle for you behind the scenes: The complete hours worked by staff members is increased by their pay prices.

Local Payroll Services Villa Park, CA

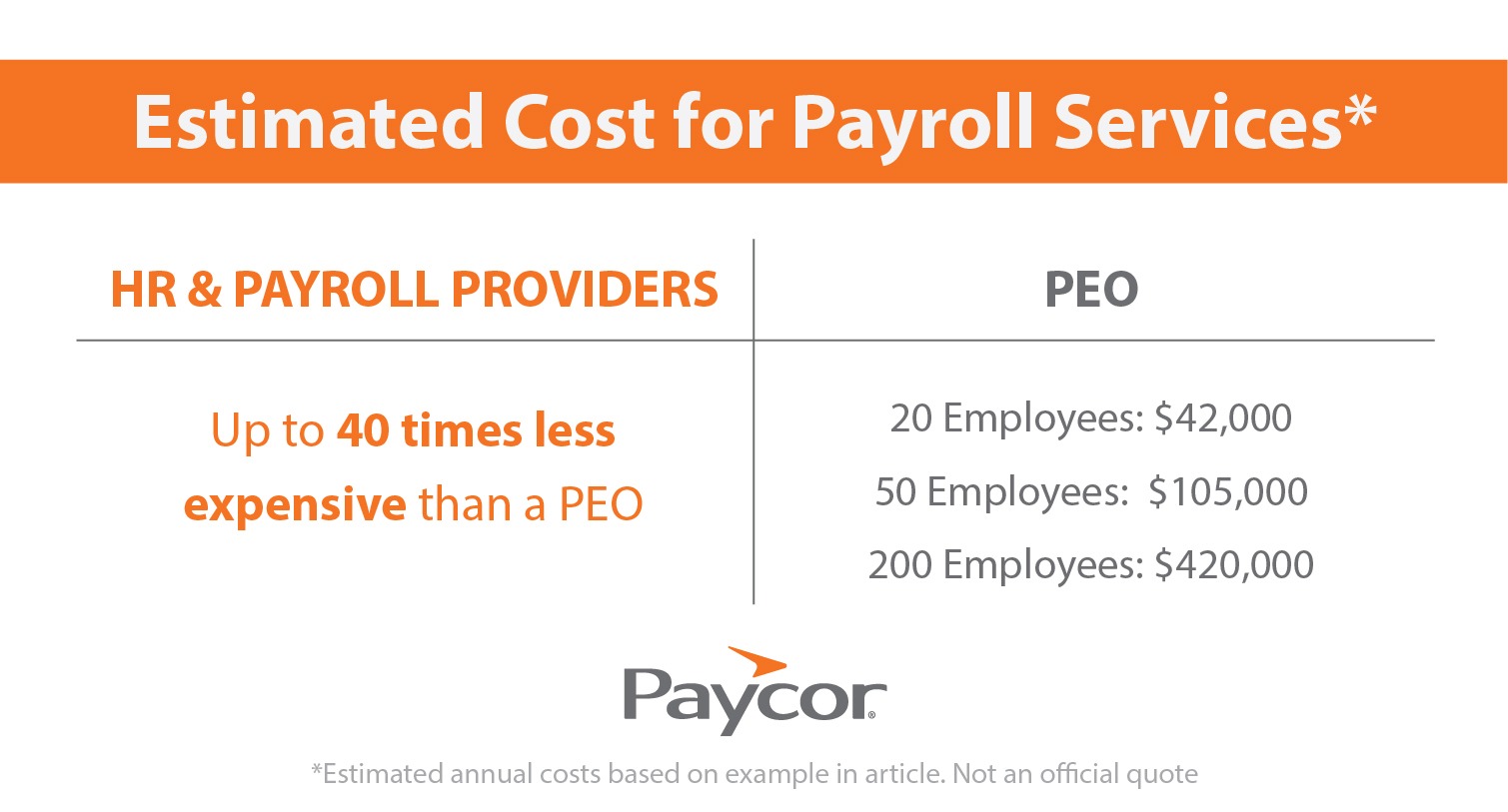

Swing pay-roll with tax filing sets you back $40 plus $6 per active employee or independent service provider monthly. This variation sets you back $20 plus $6 per active staff member or independent professional monthly.

It instantly computes, documents, and pays pay-roll tax obligations. Employers can carry out pay-roll jobs with voice assistant combinations with Siri and Google or receive text alerts.

ADP mobile remedies give employees access to their payroll details and benefits, no issue where they are. Staff members can complete a range of jobs, such as sight their pay stubs, handle their time and presence, and get in time-off demands.

Payroll And Services Villa Park, CA

This process can be time consuming and error susceptible without the correct resources. That's why lots of companies turn to payroll solution providers for automated services and conformity know-how. Companies usually aren't called for to keep taxes from settlements to independent contractors, which streamlines payroll processing. Nevertheless, a pay-roll service may still be of help.

Processing payroll in numerous states needs tracking, understanding and following the tax obligation laws and laws in all states where you have staff members. You might likewise need to register your organization in those states even if you do not have a physical place. Discover much more concerning multi-state conformity If you're doing payroll by hand currently and plan to switch to a pay-roll provider, you must expect to minimize the time you devote to the process.

ADP supplies pay-roll solutions for organizations of all dimensions tiny, midsized and large. We likewise accommodate many sectors, including construction, production, retail, healthcare and even more. ADP's payroll solutions are automated, making it simple for you to run pay-roll. Right here are a few of the key actions to the process that we'll handle for you behind the scenes: The total hours functioned by employees is multiplied by their pay prices.

Wave payroll with tax obligation filing costs $40 plus $6 per energetic employee or independent contractor monthly. For companies beyond these states, you can pick the self-service alternative. In this situation, Wave computes your payroll tax obligations, yet you file the papers and pay the tax obligations on your own. This version sets you back $20 plus $6 per energetic staff member or independent contractor monthly.

Key Man Insurance Vs Life Insurance Villa Park, CA

Harmony SoCal Insurance Services

Address: 2135 N Pami Circle Orange, CA 92867Phone: (714) 922-0043

Email: info@hsocal.com

Harmony SoCal Insurance Services

It instantly determines, files, and pays payroll taxes. Employers can perform pay-roll tasks with voice aide integrations with Siri and Google or get text alerts.

Church Payroll Services Villa Park, CAEmployee Benefits Consultants Villa Park, CA

Employee Benefits Broker Near Me Villa Park, CA

Employee Benefits Consulting Villa Park, CA

Close To Me Seo Marketing Agency Villa Park, CA

Affordable Seo For Small Business Villa Park, CA

Employee Benefits Solutions Villa Park, CA

Harmony SoCal Insurance Services

Table of Contents

- – Employee Benefits Management Solutions Villa Pa...

- – Harmony SoCal Insurance Services

- – Payroll Services For Small Business Villa Park...

- – Payroll Services Villa Park, CA

- – Payroll Services Small Business Villa Park, CA

- – Best Payroll Services For Small Businesses Vi...

- – Local Payroll Services Villa Park, CA

- – Top Employee Benefits Brokers Villa Park, CA

- – Payroll Service For Small Businesses Villa P...

- – Church Payroll Services Villa Park, CA

- – Payroll Services For Small Business Villa Pa...

- – Local Payroll Services Villa Park, CA

- – Payroll And Services Villa Park, CA

- – Key Man Insurance Vs Life Insurance Villa Pa...

- – Harmony SoCal Insurance Services

Latest Posts

Solana Beach Gas Water Heater Maintenance

Del Mar Replace Water Heater

La Jolla Water Heater Repair Near Me

More

Latest Posts

Solana Beach Gas Water Heater Maintenance

Del Mar Replace Water Heater

La Jolla Water Heater Repair Near Me