All Categories

Featured

Table of Contents

- – Estate Planning With Life Insurance Orange Coun...

- – Harmony SoCal Insurance Services

- – Family Plan Life Insurance Orange County, CA

- – Blue Cross Blue Shield Health Insurance Plans ...

- – Life Insurance Term Plan Orange County, CA

- – Life Insurance Family Plan Orange County, CA

- – Family Plan Health Insurance Orange County, CA

- – Health Insurance Plans For Family Orange Cou...

- – Life Insurance Term Plan Orange County, CA

- – Affordable Life Insurance Plans Orange Count...

- – Personal Health Insurance Plans Orange Count...

- – Harmony SoCal Insurance Services

Estate Planning With Life Insurance Orange County, CA

Harmony SoCal Insurance Services

2135 N Pami Circle Orange, CA 92867(714) 922-0043

https://maps.google.com/maps?ll=33.823884,-117.830838&z=16&t=h&hl=en&gl=US&mapclient=embed&cid=276141583131225364

Strategy costs and benefits vary. The advantages, rates and expenses listed in these promotions are illustratory and are based on a particular family size, certain age, cigarette smoker status, and in a specific Ambetter Health and wellness insurance coverage location. No individual needs to send money to an issuer of Ambetter Medical insurance in action to this national promotion.

It needs to be noted that Ambetter Wellness Insurance policies have exemptions, constraints, reduction of advantages, and terms under which the policy may be continued effective or discontinued. Ambetter Wellness Insurance policy plans additionally include arrangements connecting to renewability, cancellability, and discontinuation, and might include provisions for alteration of benefits, losses covered or premiums due to age or for other reasons.

Some areas do not offer $0 costs strategies. Plan costs and advantages differ. Inspect eligibility standing Ambetter Health and wellness Insurance policy is only supplied in the adhering to states and expenses may differ by state and area: AL (Ambetter of Alabama); AR (Ambetter from Arkansas Health And Wellness & Wellness); AZ (Ambetter from Arizona Complete Health); CA (Ambetter from Health And Wellness Web); FL (Ambetter from Sunlight Health consists of EPO products that are underwritten by Celtic Insurance Business, and HMO items that are financed by Sunlight State Wellness Plan); GA (Ambetter from Peach State Wellness Strategy); IL (Ambetter of Illinois, Guaranteed by Celtic Insurance Policy Firm); IN (Ambetter from MHS); KS (Ambetter from Sunflower Wellness Plan, Insured by Celtic Insurance Policy Business); KY (Ambetter from WellCare of Kentucky); LA (Ambetter from Louisiana Medical Care Connections); MI (Ambetter from Meridian); MO (Ambetter from Home State Health And Wellness, Insured by Celtic Insurance Coverage Business); MS (Ambetter from Magnolia Health And Wellness); NE (Ambetter from Nebraska Total Amount Care); NC (Ambetter of North Carolina Inc.); NH (Ambetter from NH Healthy And Balanced Households ); NJ (Ambetter from WellCare of New Jacket); NM (Ambetter from Western Skies Community Treatment); NV (Ambetter from SilverSummit Healthplan); OH (Ambetter from Buckeye Health And Wellness Strategy); OK (Ambetter of Oklahoma); (Ambetter from PA Health & Wellness); SC (Ambetter from Outright Total Amount Care); TN (Ambetter of Tennessee); TX (Ambetter from Superior HealthPlan consists of EPO products that are underwritten by Celtic Insurance policy Business, and HMO products that are financed by Superior HealthPlan, Inc.); and WA (Ambetter from Coordinated Treatment Firm).

Maine's medical insurance market provides several options for major clinical and dental insurance coverage. is the one stop shop for Mainers seeking health coverage. There you will certainly discover information regarding acquiring major clinical insurance coverage, getting approved for cost-free or affordable MaineCare insurance coverage, and just how and where to break out aid with your questions and applications.

Family Plan Life Insurance Orange County, CA

Other plans - called restricted benefit plans - may seem like they will conserve you cash but can cost you sometimes extra if you have a significant health problem, hospitalization, or crash calling for healthcare. To read more regarding what goes into a detailed major clinical strategy see the info concerning Market Program at .

People and family members can purchase oral insurance coverage either as a "stand alone" item (purchased independently) or as component of a clinical strategy. Information regarding both choices can be found at . Stand alone strategies can also be viewed on the adhering to charts: Stand Alone Dental Strategy Comparison for People keep in mind: kids covered by medical plans bought with need to have dental insurance coverage, and subsidies can only be put on pediatric oral plans acquired at .

* Telemedicine is no expense after insurance deductible for members in HSA plans. Teladoc and relevant marks are trademarks of Teladoc Health, Inc. and are used by ConnectiCare with approval

Blue Cross Blue Shield Health Insurance Plans Orange County, CA

Yet it does cover long-lasting treatment, real estate help, or environment benefits. Like OHP, OHP Bridge is totally free. That means no month-to-month repayments, no co-pays, no coinsurance, and no deductibles. Learn extra regarding OHP Bridge. Private health insurance (likewise called personal wellness protection) are sold through the Industry. People in every county in Oregon can get a plan there.

That suggests they don't have to pay for deductibles, co-pays, coinsurance, or prescriptions. Medicare is health insurance coverage for people 65 and older.

The government VA offers wellness treatment for experts in Oregon. There are three full-service Clinical Centers and lots of smaller Community-Based Outpatient Clinics (CBOCs) around the state.

Life Insurance Term Plan Orange County, CA

Find the information you require about open registration, unique registration, crucial dates, and when to enroll.

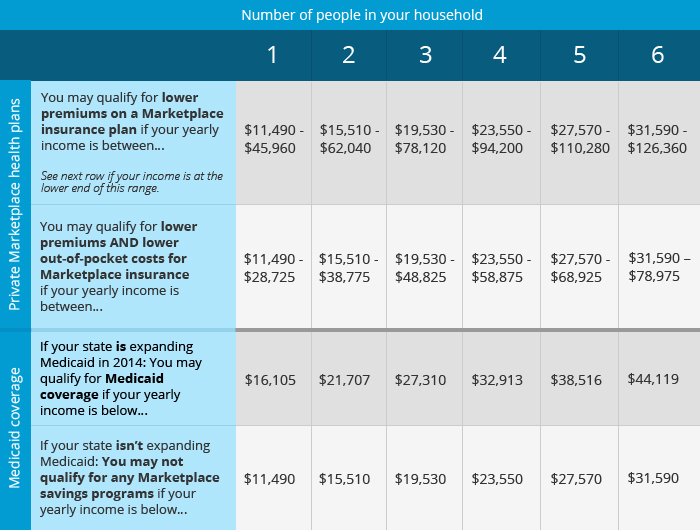

The selection is all your own. As soon as plan alternatives appear, you'll see prices, metal tier choices and gain from all the different carriers in The golden state. Furthermore, you'll see if you qualify to obtain federal government assistance, which will enable you to receive reduced rates. Your quotes will certainly include: Service provider name (Kaiser Permanente, Anthem Blue Cross, etc) Strategy classification (PPO, HMO and EPO) Plan type (Bronze, Silver, Gold or Platinum) Overall rate of the strategy Rate you will pay Aid you certify for The good news is that there is a health and wellness insurance policy prepare for every person.

Which Is the Finest Health Insurance Strategy for You? Whether you are a family with lots of doctor consultations or one that simply wants to be covered for emergency situations, there is a strategy to match your requirements.

Life Insurance Family Plan Orange County, CA

Learn a lot more regarding all the treatment plans below. With this health insurance plan, you will certainly make little monthly repayments while still receiving insurance coverage for a few appointments and preventative treatment. You will have to pay a bit much more if you require to see a professional. This strategy is particularly optimal for youths without any dependents.

With this strategy, you will certainly make ordinary month-to-month payments while getting budget-friendly medical insurance coverage in The golden state that covers all the basics and more. You'll spend a little bit extra if you require outpatient surgical treatment or check out the hospital. This plan is best if you are an individual that strives to guarantee your wellness is always in check.

Family Plan Health Insurance Orange County, CA

You will certainly make small monthly payments and have low out-of-pocket prices in situation you see a professional or check out a health center. The best point is that you'll have a reduced insurance deductible to meet, conserving you a lot in the future. With this health insurance plan, you will certainly make greater regular monthly payments, and obtain routine doctor gos to, emergency situations and preventative treatment, without needing to satisfy a deductible.

The least costly health and wellness insurance quote on each metallic plan is found on the. If you desire to see additional strategies at greater costs, you can scroll to the.

A kind of wellness plan that gets with clinical providers, such as healthcare facilities and doctors, to create a network of getting involved service providers. You pay less if you use carriers that come from the plan's network. You can utilize medical professionals, hospitals, and suppliers outside of the network for an added price.

Each of our plans covers different counties in North Carolina, and they include a variety of options to select from. To discover which strategies are readily available in your location, go into some information to get a quote based on your personal demands.

Health Insurance Plans For Family Orange County, CA

Due to the fact that there are numerous different kinds of health insurance plan, you ought to make certain to look for the one that fits your requirements. Extensive medical insurance supplies advantages for a broad range of health treatment solutions. These health insurance plan use a detailed list of wellness benefits, may restrict your prices if you get services from one of the suppliers in the plan's network, and typically call for co-payments and deductibles.

You are just covered if you obtain your treatment from HMO's network of carriers (except in a case of emergency situation). With many HMO plans you pay a copayment for every covered solution. For instance, you pay $30 for a workplace browse through and the HMO pays the rest of the cost.

These plans have a network of preferred providers that you can utilize, however they additionally cover solutions for out-of-network companies. PPP's will certainly pay more of the cost if you utilize a company that remains in the network. Example: After copays and deductibles, the strategy pays 100% of a service for a network supplier but 80% for an out-of-network (OON) carrier.

Significant clinical plans typically cover healthcare facility and clinical costs for a mishap or health problem. These plans generally cover a percent of your protected expenses.

Life Insurance Term Plan Orange County, CA

Whether you pick a major medical strategy, an HMO or a PPP, your strategy will possibly have some "cost-sharing" functions. This implies that you share the expense of care by paying component of the cost for each and every service and the insurance policy firm pays the remainder. Pick a plan that works finest with the kind of health insurance you assume you will utilize.

Instance, you pay $30 for an office browse through and the strategy pays the rest. A Strategy might have different copayments for different kinds of services. The copayment for a health care browse through might be $30 and copayment for an emergency clinic check out may be $150. An insurance deductible is the quantity you pay before the plan begins to spend for the majority of covered services.

You pay a $2,500 insurance deductible towards your wellness treatment solutions yearly before the plan pays any Coinsurance is a percent of the allowed cost that you spend for a covered service advantages. Coinsurance is a percent of the enabled charge that you pay for a protected service. You pay 20% of the price of a covered workplace browse through and the plan pays the remainder.

The strategy might enable only 10 brows through to a chiropractic doctor. The plan may leave out (not pay for) cosmetic surgical procedure, and you will certainly pay for the entire price of service.

Affordable Life Insurance Plans Orange County, CA

There are numerous various methods that you can get a health plan in Massachusetts. Numerous individuals get their health plan through their area of work.

You can choose the health insurance that is ideal for you from the choices offered. If you are registered as a trainee in a Massachusetts college or college, you can get a wellness strategy via your school. This SHIP id made for pupils and is just readily available while you are enlisted.

And the firm can not transform you down if you have a wellness condition. Often the company will guide you to acquire their health and wellness strategy through an intermediary.

Personal Health Insurance Plans Orange County, CA

Harmony SoCal Insurance Services

Address: 2135 N Pami Circle Orange, CA 92867Phone: (714) 922-0043

Email: info@hsocal.com

Harmony SoCal Insurance Services

You can discover more at or call 1-800-841-2900 If you do not help a company that pays at the very least 33% of your health insurance plan costs, you might have the ability to buy a health insurance from the Port. These are strategies provided by Massachusetts HMOs that the Connector has selected to have great value.

Life Insurance Planning Orange County, CAPersonal Health Insurance Plans Orange County, CA

Health Insurance Plans For Family Orange County, CA

Finding A Local Seo Orange County, CA

Around Me Seo Citations Orange County, CA

Harmony SoCal Insurance Services

Table of Contents

- – Estate Planning With Life Insurance Orange Coun...

- – Harmony SoCal Insurance Services

- – Family Plan Life Insurance Orange County, CA

- – Blue Cross Blue Shield Health Insurance Plans ...

- – Life Insurance Term Plan Orange County, CA

- – Life Insurance Family Plan Orange County, CA

- – Family Plan Health Insurance Orange County, CA

- – Health Insurance Plans For Family Orange Cou...

- – Life Insurance Term Plan Orange County, CA

- – Affordable Life Insurance Plans Orange Count...

- – Personal Health Insurance Plans Orange Count...

- – Harmony SoCal Insurance Services

Latest Posts

Tankless Water Heater Flush La Jolla

Torrey Pines Plumber Near Me Clogged Toilet

Del Mar Plumbing Repairs Near Me

More

Latest Posts

Tankless Water Heater Flush La Jolla

Torrey Pines Plumber Near Me Clogged Toilet

Del Mar Plumbing Repairs Near Me