All Categories

Featured

Table of Contents

- – Cheap Medicare Supplement Plans Buena Park, CA

- – Harmony SoCal Insurance Services

- – Vision Insurance For Seniors On Medicare Buena...

- – Insurance Seniors Buena Park, CA

- – Employee Benefits Consulting Company Buena Pa...

- – Term Insurance For Senior Citizens Buena Par...

- – Term Insurance For Senior Citizens Buena Par...

- – Dental And Vision Insurance For Seniors Buen...

- – Contractor Payroll Services Buena Park, CA

- – Individual Health Insurance Plans Buena Park...

- – Vision Insurance For Seniors On Medicare Bue...

- – Final Expense Insurance For Seniors Buena Pa...

- – Vision Insurance For Seniors On Medicare Bue...

- – Human Resources And Payroll Services Buena P...

- – Best Payroll Service Buena Park, CA

- – Harmony SoCal Insurance Services

Cheap Medicare Supplement Plans Buena Park, CA

Harmony SoCal Insurance Services

2135 N Pami Circle Orange, CA 92867(714) 922-0043

Harmony SoCal Insurance Services

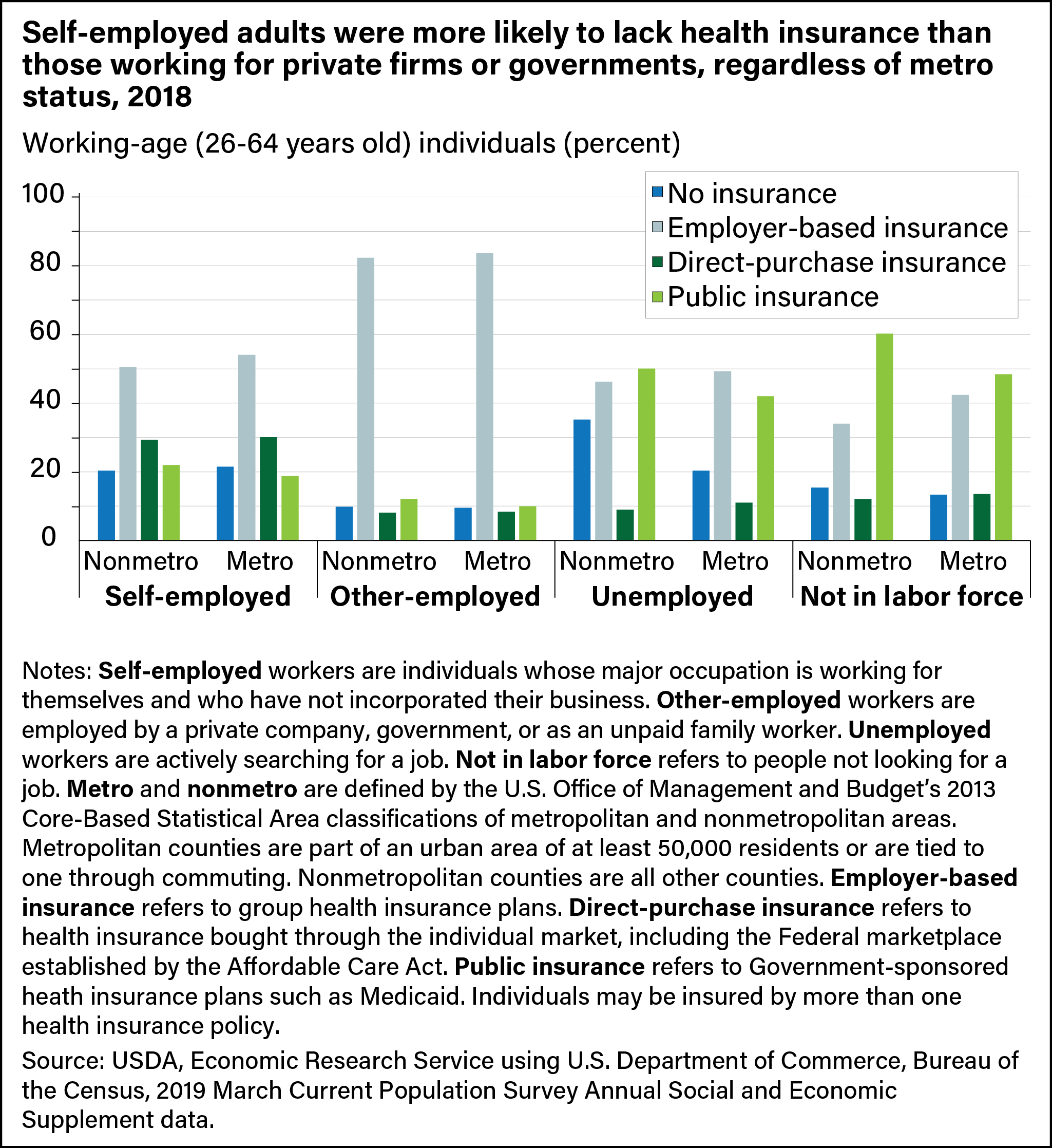

If you're self-employed and you need health and wellness insurance policy protection and you have pre-existing conditions, you should see if you qualify for an Unique Enrollment Period. As soon as you sign up and pay your premium, coverage typically starts right away.

: Health and wellness insurance policy costs. If you are not gathering jobless benefits, paying COBRA premiums, or impaired, paying for health and wellness insurance with HSA dollars will certainly trigger earnings tax responsibility and if you are under 65 years old, a 20% fine for a non-qualified distribution.

Vision Insurance For Seniors On Medicare Buena Park, CA

You can declare the freelance wellness insurance policy reduction as a change to your gross earnings on time 1 of Form 1040. It's an "over the line" reduction. You don't have to detail in order to claim the reduction. Numerous individual medical insurance plans and wellness sharing prepares offer extra sources, such as telemedicine solutions, health cares, and access to preventative care.

You ought to chat to an Aetna agent regarding your options based on location and income or see your strategy choices by entering your zip code on Aetna's web site. Another benefit for self-employed professionals on a budget is Aetna's inexpensive MinuteClinic solutions.

For various other solutions, doctor copays start at $20. Aetna is not the most economical option if you do not get approved for superior tax obligation credit histories through the ACA. Health Insurance Plans For Students Buena Park. Nevertheless, the business has a credibility for reliability, with an A ranking from AM Best and an A+ from the BBB. Extensive provider networkHighly ranked client service Simple app for plan information and cardHigher-cost costs for individualsLimited strategy options in some states Why we selected it: With 1.3 million healthcare companies and over 6,500 healthcare facilities, United Healthcare's network is just one of the most expansive in the nation.

United Health care is readily available in all 50 states and supplies a large array of insurance policy products. Certified people can access Medicare and Medicaid prepares with United and can get short-term and extra insurance coverage. This business isn't the cheapest medical insurance for an independent person. Ordinary premium expenses for a healthy 30-year-old are around $400, with household plans ranging upwards of $1,200.

Insurance Seniors Buena Park, CA

We picked this firm for its comfort and perks including online appointments and home shipments for prescription drugs. Also though it is not available in all 50 states, Cigna supplies affordable HMO and EPO plans, as well as fine-tuned on the internet services, for self-employed professionals in the adhering to states and area: Arizona, The Golden State, Colorado, Connecticut, Florida, Georgia, Maryland, Missouri, North Carolina, South Carolina, Tennesse, and Washington, D.C

It also provides oral insurance coverage and Medicare Part D prescription medicine strategies in all 50 states. Cigna's most enticing functions make it practical for people to access health care. These consist of access to 24/7 virtual treatment and prescription shipment. That implies Cigna members can chat with their medical professional, obtain a prescription, and have their medication delivered without ever before leaving home, which is an advantage to self-employed people who function from home.

The insurance company doesn't have a BBB ranking and has a high number of consumer problems. Possible consumers must be aware of this prior to choosing on an insurance provider.

Employee Benefits Consulting Company Buena Park, CA

Molina Medical care challenges the regulation that more affordable medical insurance isn't necessarily much better. Commonly, an inexpensive strategy with minimal insurance coverage won't help much when you require to see a doctor. Nevertheless, Molina Healthcare is a major insurance company that provides dependable protection for a low costs. While Molina is available in all 50 states, its ACA strategies are only offered in 14 states.

Doctor copays start at $0. A lot of strategies feature cost-free virtual check outs and low-cost prescriptions. Molina has a contemporary application that participants can use to speak to a nurse or for more information concerning their strategy. This firm has a B ranking from AM Finest, slightly less than standard for a significant insurance coverage company.

Humana's PPO plans allow you to select your physician, you'll conserve even more cash if you stay in the business's network. With Medicare Benefit, you can pay around $30 per month for a PPO plan.

Digital solutions with a $0 copayConvenient appLow-cost plan optionsNot available in all 50 statesHigh rate of consumer complaints If you want the assurance that features 24/7 virtual care, you might wish to take into consideration Oscar. This is an up-to-date healthcare company that allows you speak with a doctor and get a prescription anytime, without leaving home.

Term Insurance For Senior Citizens Buena Park, CA

It's quick, practical and free with the majority of Oscar plans. A whole lot of medical insurance companies today use virtual services yet many don't use it 24/7. The drawback is that Oscar is currently just readily available in 22 states. All strategies in those states are eligible for aids through the ACA.

The Oscar app allows members to track their insurance deductible, talk to a medical professional and re-fill prescriptions anytime. While the application is rated at 4.7/ 5 celebrities, the firm obtains a high price of issues.

Term Insurance For Senior Citizens Buena Park, CA

As a Freelancers Union member, you can shop for strategies and enroll through their website. Links consultants to wellness insurance coverage plansFree to joinNot a real wellness insurance policy companyPlan alternatives vary by area Kaiser Permanente is one of the most popular employer-sponsored healthcare business on the market, however it isn't the ideal for specific strategies.

To begin, you must understand which kind of wellness insurance plan you desire. With employer-sponsored health insurance policy, you generally have one or 2 plans to select from.

An HMO plan limits your health care alternatives to a predefined network of providers. That implies less freedom to select your physician or hospital but relatively reduced premiums and deductibles than other sorts of strategies. Under an HMO, you typically have a medical care supplier that will certainly refer you to various other professionals within the network.

Dental And Vision Insurance For Seniors Buena Park, CA

Wellness insurance coverage firms place their strategies in "metal" levels: Bronze, Silver, Gold and Platinum. Alternatively, higher-tier plans come with reduced deductibles and out-of-pocket optimums.

If you're trying to find an IRS self-employment medical insurance reduction for a higher-tier strategy, you'll wish to talk to an insurance policy representative regarding your clinical history. Many ACA and state programs offer inexpensive Bronze or Silver plans however make exemptions for individuals with disabilities or pre-existing problems. What is the finest health and wellness insurance for self-employed professionals? It varies from one person to another.

Contractor Payroll Services Buena Park, CA

The best health and wellness insurance for independent household participants and people comes down to a number of elements including your income, location, and health problem, simply to name a few. We mentioned a few health insurance policy markets in the list over: Freelancers Union and the ACA industry, but there are additionally regional and state marketplaces.

Keep in mind that a marketplace is not an insurance policy business; you'll browse plans from different companies. Under the Affordable Care Act, each state has its very own sponsored health insurance program.

Those consist of: A federally-sponsored insurance coverage for adults 65 and older. A needs-based wellness insurance not supplied by an employer.

Individual Health Insurance Plans Buena Park, CA

Relying on your home earnings and health and wellness problems, you can often access reduced or totally free health care strategies. One means to discover the most effective health insurance plans for self-employed individuals is to get in touch with a union or subscription organization, such as the abovementioned Freelancers Union. Other choices consist of: AARP Writers Guild of America Small Company Service Bureau National Organization of Female Executives A few of these organizations offer team plans, which counter the cost of wellness insurance policy without a company.

Buying a plan can save you from intense financial obligation and aid avoid severe wellness conditions. Usually, you should expect to spend around 10% of your household earnings on health insurance.

We chose the seven insurance firms on this listing based on their worth for independent workers. Right here are a couple of aspects we considered: Exactly how much is wellness insurance coverage for independent individuals?

Vision Insurance For Seniors On Medicare Buena Park, CA

While several of the firms assessed on this list are extra pricey than others, they also give more detailed protection, meaning participants obtain what they pay for. However, not all medical insurance plans are readily available in all 50 states. Health insurance policy firms like Cigna have restricted availability based on place.

Your provider needs to clarify your copay for health care sees, deductibles and out-of-pocket optimum. In addition to that, the most effective medical insurance firms provide a lot of advantages with each plan, consisting of online care and wellness discount rates. Best Gold Plans Best for Tax Obligation Credit Reports Best Extensive Supplier Network Best for Prescriptions Finest Rates Best for PPO Ideal for 24/7 Emergency Situation Treatment.

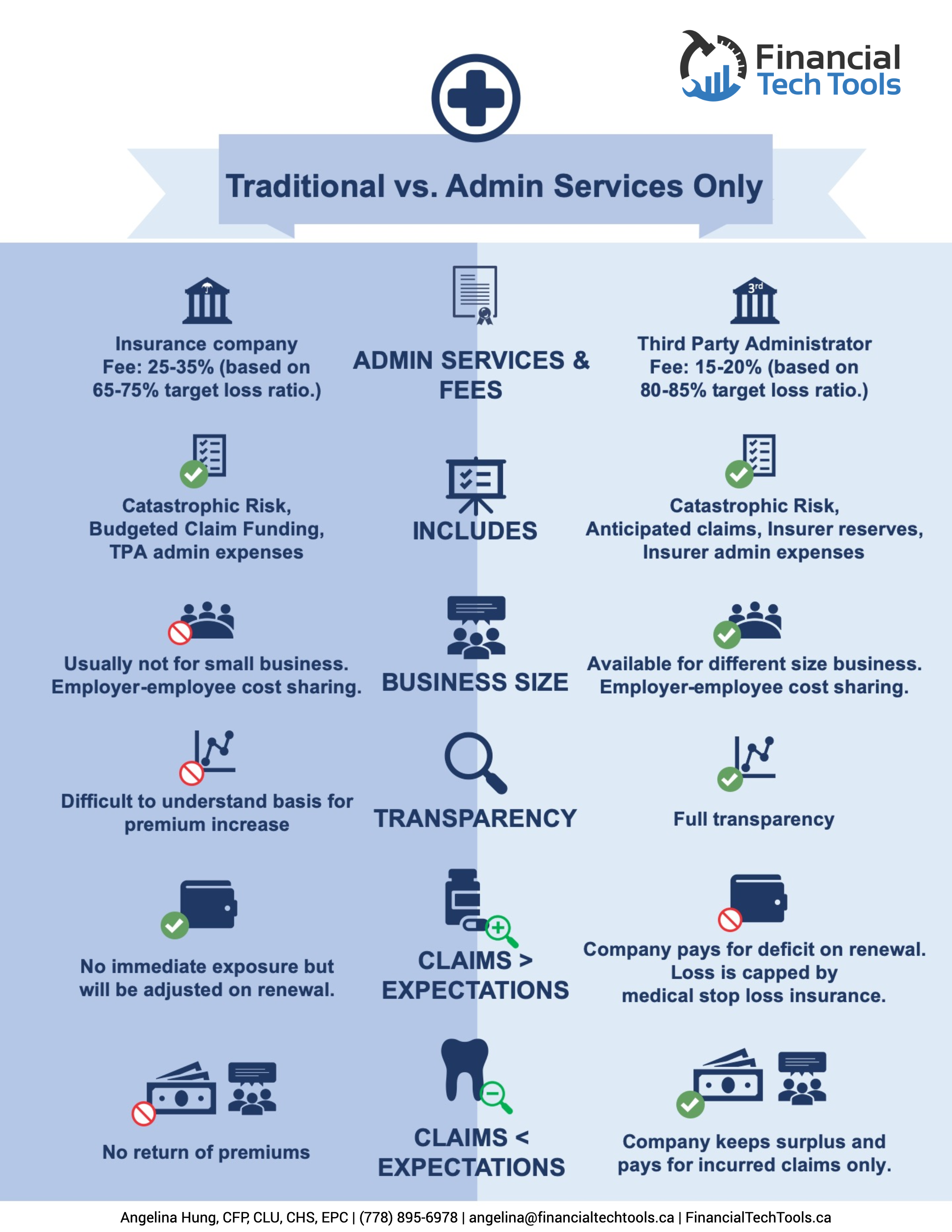

Supplying health and wellness advantages is a significant decision for businesses. Usage as a source to get more information concerning health and wellness insurance items and solutions for your workers.

Depending upon where you live, you might also be eligible for state-funded aids, in addition to the ACA's federal subsidies.: Your case history won't impact your qualification, insurance coverage, or premiums.: You can join throughout the annual open registration (Nov. 1 through Jan. 15 in many states, although a proposed federal policy change require the target date to be reset to Dec .

Final Expense Insurance For Seniors Buena Park, CA

With a POS, you will certainly have to pay up front for out-of-network care. Then you can submit a case to your insurance firm for reimbursement. Medical insurance companies place their strategies in "steel" degrees: Bronze, Silver, Gold and Platinum. The greater the steel degree, the greater the premium. Conversely, higher-tier strategies come with lower deductibles and out-of-pocket optimums.

If you're looking for an Internal revenue service self-employment health insurance policy reduction for a higher-tier plan, you'll desire to talk to an insurance coverage agent concerning your medical background. What is the ideal health insurance policy for freelance experts?

However, the very best health insurance for independent family members and people comes down to several variables including your income, location, and wellness condition, simply among others. Begin by comparing your alternatives. Listed below we have actually provided a few places you can seek health insurance in your area. We stated a couple of medical insurance marketplaces in the list above: Freelancers Union and the ACA market, however there are also regional and state industries.

Remember that a marketplace is not an insurance business; you'll browse strategies from various firms. It's vital to review the benefits and prices of each plan carefully. Under the Affordable Treatment Act, each state has its own sponsored wellness insurance coverage program. Searching for strategies details to your state will certainly aid you to narrow down your options and ensure you're obtaining the proper assistance.

Vision Insurance For Seniors On Medicare Buena Park, CA

Those consist of: A federally-sponsored insurance coverage for adults 65 and older. A needs-based wellness insurance policy not provided by a company.

Depending on your home income and health problems, you can often access affordable or cost-free medical care plans. One way to locate the very best medical insurance prepare for self-employed people is to attach with a union or subscription company, such as the aforementioned Freelancers Union. Various other choices consist of: AARP Writers Guild of America Small Business Solution Bureau National Organization of Women Executives A few of these companies supply group plans, which counter the cost of health and wellness insurance without an employer.

Acquiring a strategy can save you from intense debt and aid prevent serious health and wellness conditions. That all depends on your selected strategy and the corresponding subsidies or price cuts. Typically, you ought to anticipate to invest around 10% of your household income on medical insurance. Ensure you check out ACA and state aids to find a plan that fits your revenue.

An insurance policy representative will provide you the most accurate quote possible. It might appear a little invasive, yet you'll get a more accurate quote by supplying all the individual medical info you can. We selected the 7 insurance coverage firms on this listing based on their value for independent workers. Below are a few elements we considered: Just how much is wellness insurance for freelance people? Again, the response varies based upon need.

Human Resources And Payroll Services Buena Park, CA

While a few of the firms evaluated on this checklist are a lot more pricey than others, they likewise offer much more extensive coverage, indicating participants get what they pay for. Regrettably, not all health and wellness insurance policy plans are offered in all 50 states. Health insurance companies like Cigna have actually limited accessibility based upon location.

Your supplier must clarify your copay for health care sees, deductibles and out-of-pocket optimum. On top of that, the most effective health and wellness insurance coverage firms supply a lot of benefits with each plan, consisting of online treatment and health discounts. Best Gold Strategies Best for Tax Obligation Credit Scores Ideal Expansive Carrier Network Finest for Prescriptions Ideal Rates Best for PPO Best for 24/7 Emergency Situation Treatment.

Supplying wellness benefits is a significant choice for organizations. Use as a source to find out more concerning health insurance policy products and services for your staff members.

Best Payroll Service Buena Park, CA

Harmony SoCal Insurance Services

Address: 2135 N Pami Circle Orange, CA 92867Phone: (714) 922-0043

Email: info@hsocal.com

Harmony SoCal Insurance Services

Cheap Term Insurance For Seniors Buena Park, CA

Best Funeral Insurance For Seniors Buena Park, CA

Best Health Insurance Plans For Self Employed Buena Park, CA

Around Here Seo Solutions Buena Park, CA

Find A Good Seo Marketing Company Buena Park, CA

Health Insurance Plans For Students Buena Park, CA

Harmony SoCal Insurance Services

Table of Contents

- – Cheap Medicare Supplement Plans Buena Park, CA

- – Harmony SoCal Insurance Services

- – Vision Insurance For Seniors On Medicare Buena...

- – Insurance Seniors Buena Park, CA

- – Employee Benefits Consulting Company Buena Pa...

- – Term Insurance For Senior Citizens Buena Par...

- – Term Insurance For Senior Citizens Buena Par...

- – Dental And Vision Insurance For Seniors Buen...

- – Contractor Payroll Services Buena Park, CA

- – Individual Health Insurance Plans Buena Park...

- – Vision Insurance For Seniors On Medicare Bue...

- – Final Expense Insurance For Seniors Buena Pa...

- – Vision Insurance For Seniors On Medicare Bue...

- – Human Resources And Payroll Services Buena P...

- – Best Payroll Service Buena Park, CA

- – Harmony SoCal Insurance Services

Latest Posts

Universal City Hvac Contractor Reviews

Commercial Exhaust Fan Repair Verdugo City

Health Insurance Plans For Students Buena Park

More

Latest Posts

Universal City Hvac Contractor Reviews

Commercial Exhaust Fan Repair Verdugo City

Health Insurance Plans For Students Buena Park